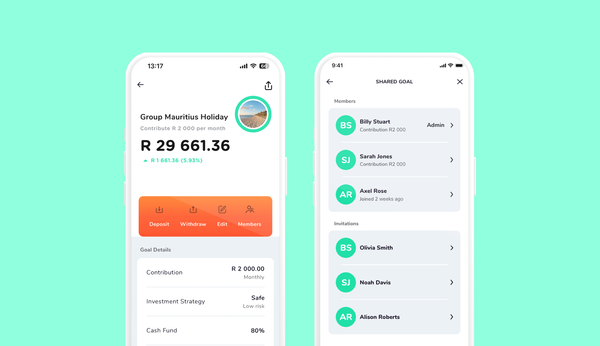

New Feature on the Franc App: Shared Goals 🤝

We’ve launched a brand new feature on the Franc App: Shared Goals! Now you can invest and save towards goals you share with friends, family and colleagues.

We’re frank about finances, and here to simplify investing and money management for everyone.

We’ve launched a brand new feature on the Franc App: Shared Goals! Now you can invest and save towards goals you share with friends, family and colleagues.

They say your investment is like a bar of soap – the more you handle it, the smaller it gets. If you're tempted to dip into your long-term investments this festive season, give this blog post a read first.

If you find yourself in a debt trap, and need help finding your way out, debt counselling might be a consideration for you. We explain what the debt counselling process is, advantages and disadvantages, and the costs.

Buy-now-pay-later (or BNPL) platforms have sprung up all over the place in the last few years. In this blog, we’ll explain how this payment arrangement works, what its benefits are, and what drawbacks it can have.

As at the 31 October 2023, the Satrix Top 40 ETF closed at R64.12. Get the lowdown on what that means and why.

Many people in the investment world often say that it is essential to have a “diversified investment portfolio”. But what exactly does that mean and why is it important?

As a parent, investing in your child's future is crucial, especially considering the high cost of raising a child. But should you open an investment in your child's name, or your own?

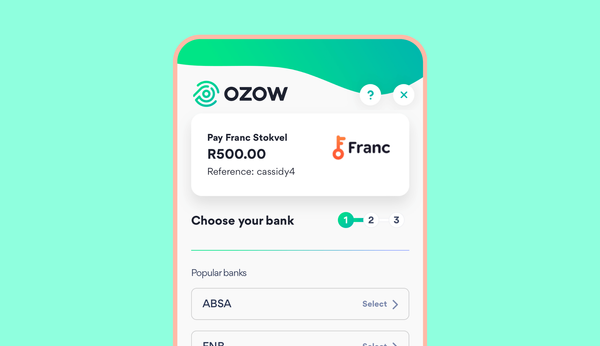

This is an important update to Franc investors to let you know that as of Wednesday, 1 November 2023, we're changing our InstantEFT payment provider to Ozow.

South Africa has no shortage of smart and savvy finance influencers creating financial education content and sharing their personal financial learnings on your social media feeds. Here are our top 9 South African influencers you should give a follow.