The lowdown: As at the 31 October 2023, the Satrix Top 40 ETF closed at R64.12. That’s a decrease of 5% over the past month (R67.50), but a 6.5% increase from 31st October 2022 (R60.24).

The analysis: Looking at it month-on-month, October was a scary month for the Top 40 companies. Only 7 companies were in the green, while the share prices of the rest were slashed by Freddy Kruger himself - Halloween haunting the top 40 companies this past month.

Comparing the fund year-on-year, however, reminds us why this fund is a long-term investment. While short-term fluctuations might take you on a horror movie-worthy rollercoaster of emotions, longer-term growth is still consistent and strong.

So how did the Satrix Top 40 ETF do?

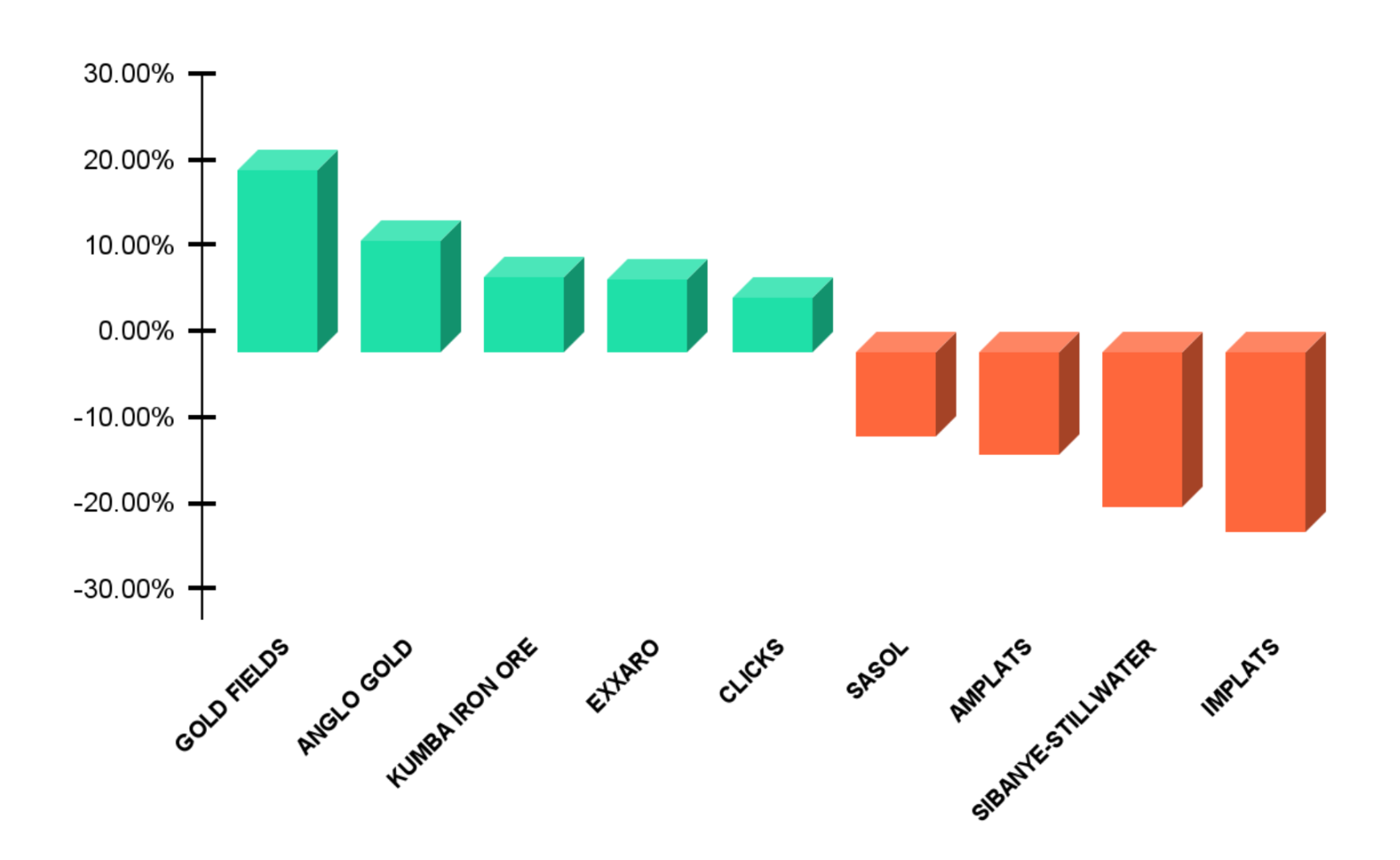

Let’s look at the performance of the top and bottom performing Satrix Top 40 companies’ shares to understand the decrease over this past month:

Top-Performing Satrix Top 40 ETF Companies

The biggest winners this past month were the gold mining companies, with Gold Fields share price increasing 21%. This increase was due to a combination of the increase in gold prices (as the war in the Middle East rages on) and the announcement of their new CEO, which rocketed their share price more than 4% on the same day. AngloGold also had an impressive month, with their share price gaining 13% during the same period.

Other big winners this October have been Kumba Iron Ore and Exxaro as Kumba’s share price increased 8.5%, while Exxaro’s share price also gained 8.5%. These gains were mostly due to increases in iron ore prices.

The market has welcomed the promising financial results of Clicks as its share price gained more than 6% this month. This was due to the group reporting an increase in turnover of 12%, while operating profit increased by 9%. The hike in earnings, along with an increased dividend declaration and record market share gains ensured a positive October for the drug retailer.

Bottom-Performing Satrix Top 40 ETF Companies

While the gold and iron ore companies were leading the race this past month, bringing up the rear were the PGM (Platinum Group Metals) companies. Sibanye-Stillwater, Amplats and Implats – who are some of the biggest PGM producers in the world – all continue to struggle due to weak PGM prices, power woes, cable theft and logistic issues. Sibanye-Stillwater share price fell 18%, while Amplats was down 12% and Implats - who fared the worst - decreased 21%.

Another one towards the back of the pack was Sasol as their share price slumped 10%. This is due to a huge decline in annual earnings as operational challenges, higher costs and volatile market conditions hit the synthetic fuels and chemicals producer.

Salads Don’t Increase Share Prices!

Going into November, many retail companies will be looking ahead to Black Friday, anticipating frenzied demand. However, coming off the back of a haunted October, there are many early Black Friday deals to be found already. Seeing as October wasn’t the month we had hoped for as the only green seen was on Bok Fridays, hopefully the top 40 companies can take some advice from our Springboks and eat more cake than salad to force the Satrix 40 ETF over the line and into the green in the months to come.