Our mission at Franc is to keep investing as simple as possible so that it becomes easy and intuitive for our customers to start building their wealth. One of the ways we’ve done that is by offering just the top-performing, lowest-cost funds in every category. Until now, that’s included two funds: the Allan Gray Money Market Fund and the Satrix Top 40 ETF.

We knew that if we ever decided to add more products to our offering, there would need to be a compelling reason to do so and we would need to ensure that the platform is still super easy to navigate.

As of 16 April 2024, we’re excited to announce that our Franc investors will be able to access a top-performing, low-cost offshore equity fund to further diversify their portfolio.

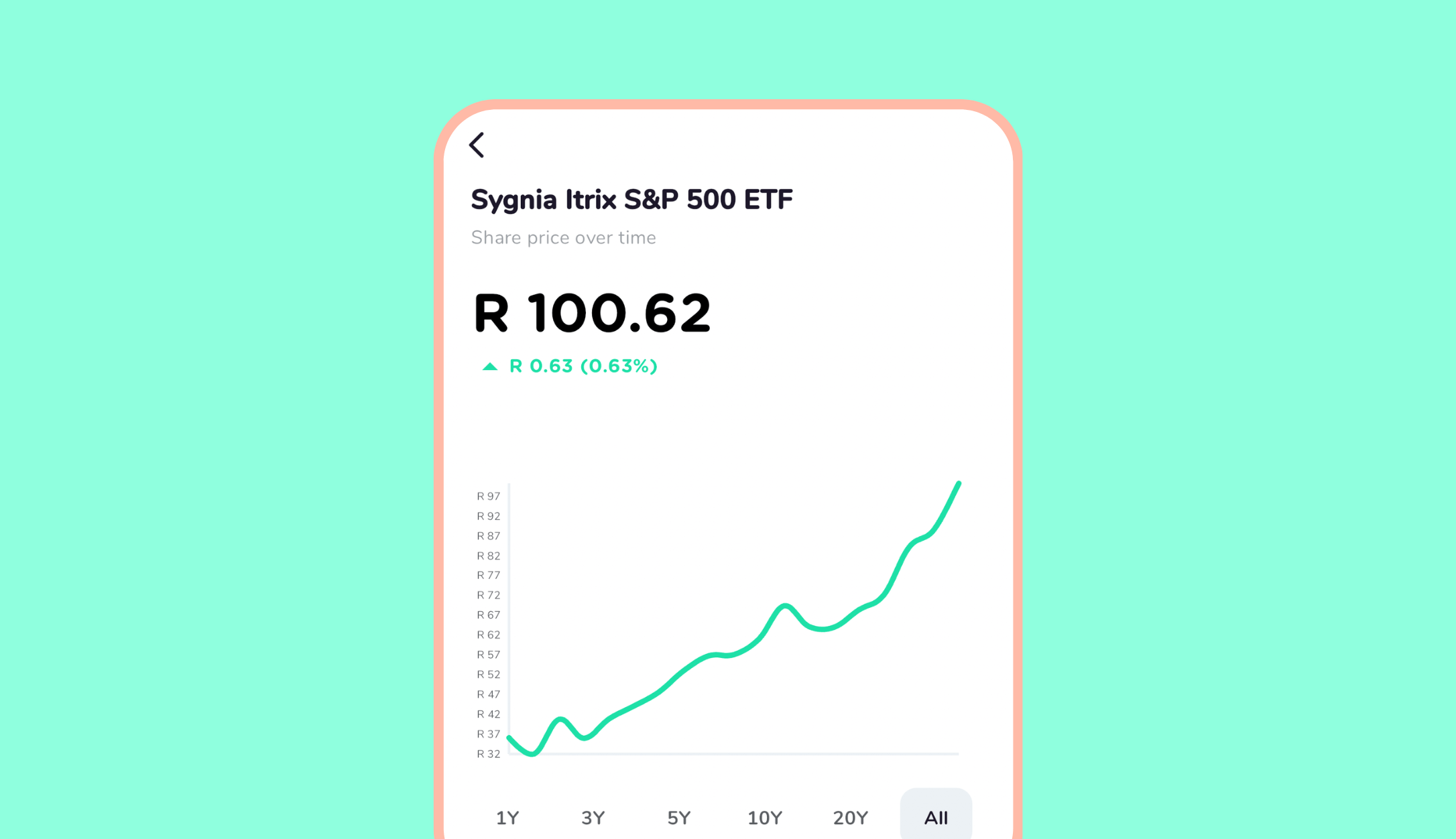

The offshore fund – the Sygnia Itrix S&P 500 ETF – will enable our investors to tap into an offshore market (the US) and global growth, without having to send money offshore or pay high fees.

Why we added an offshore equity fund

The South African stock market has done reasonably well over the past while. But there have been more companies going private (delisting from the Johannesburg Stock Exchange) than new companies listing, so the number of options available to local investors has become more limited.

This is combined with the fact that the world has changed drastically over the past 10 years when it comes to the quality and value of technology-related companies. Companies such as Meta, Amazon, Alphabet and Apple – many of which are only listed offshore – have seen phenomenal growth.

In order to give yourself the best chance of growing your money, some offshore exposure is becoming more and more important.

About the Sygnia Itrix S&P 500 ETF

When selecting an offshore equity fund to add to the Franc app offering, we were looking for a top-performing, low-cost fund that would give our investors exposure to offshore markets to diversify their portfolio.

Now, with the introduction of the Sygnia Itrix S&P 500 ETF, our Franc investors can get exposure to more than 500 of the leading businesses listed in the US.

What is an ETF?

ETF stands for exchange traded fund. It’s a fund that is traded on an exchange (like the Johannesburg Stock Exchange) exactly like a share is.

A normal share typically just gives you exposure to one company. For example, if you buy shares in MTN, you are exposed only to MTN. The difference with an ETF is that it is a basket of assets (most often shares), so when you buy an ETF, it is almost like you are buying all of the shares that are in the basket. In the case of the Sygnia Itrix, you are investing in the S&P 500, which tracks more than 500 US shares (more on that below).

Not all ETFs are created equal. A major element in its quality is how closely it actually tracks the index. The Sygnia Itrix S&P 500 ETF has a 0% tracking error which was one of the reasons we chose it above the other options. This means that the fund tracks the performance of the index almost exactly (which is what you expect it to do, but this isn’t always the case).

What is the S&P 500?

The S&P 500 is an index which tracks the performance of more than 500 companies listed in the US. So as the index performs well, so will the passively managed ETF which tracks the index.

The one thing to keep in mind though is that the Sygnia Itrix S&P 500 ETF is rand-based, so it won’t track the movement of the S&P 500 index exactly. If the rand weakens, it will increase your return. As an example, over the past 5 years or so the S&P 500 has increased 13% a year in US dollar terms, but when translated into Rands the return is around 20% a year (the rand has depreciated around 7% a year vs the US dollar).

The table below shows the top 5 companies on the index as at 4 April 2024. These 5 companies are all tech- and technology-related businesses and make up almost a quarter of the index in terms of value. As companies grow in value faster relative to other companies in the index, then their weighting will increase.

Similarly, if the value of the company goes down, its weighting will decrease.

Should you invest in the offshore equity fund through Franc?

Equity investments are best for long-term investing – when you can afford to ride out the ups and downs of market volatility and are not forced to sell.

The S&P 500 has shown very good performance recently given the boom in tech company valuations. This may not be sustainable in the short term, but only time will tell. So just make sure when you do invest in this fund, you are not looking for a quick return and that you can keep holding if there is a market correction.

How do you invest in the offshore equity fund through Franc?

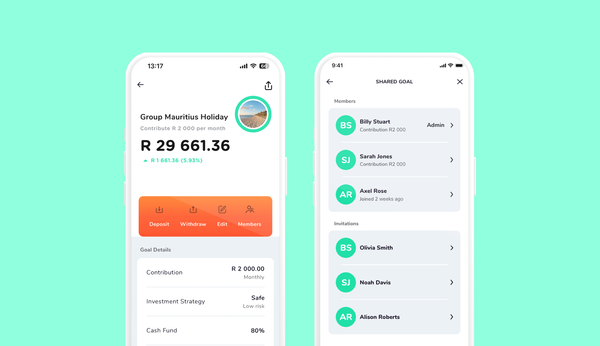

Going forward, any investment strategy you opt into that includes equity will automatically split your equity exposure 50% local (in the Satrix Top 40 ETF) and 50% offshore (Sygnia Itrix S&P 500 ETF).

If you’d like your existing investment goal to include the offshore fund, you will simply need to click on the Edit button on your goal dashboard, click the Edit Investment Strategy button and choose any of the following Investment strategies (Safe, Balanced, Bold) or customise your strategy by choosing how you want to split your investment between our cash fund, local equity fund and offshore equity fund.

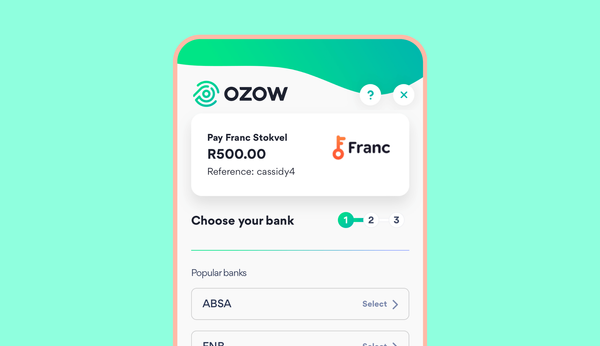

Note: Due to regulations from the fund itself, only Franc investors that are verified will have their money invested in the offshore equity fund. You can verify your account by going to the Profile tab in the Franc app. If your account is not verified, any deposit will automatically be invested in the local equity fund.

Have questions? Here are some offshore equity fund FAQs

What is Franc’s offshore equity fund?

Our offshore equity fund is the Sygnia Itrix S&P 500 Exchange Traded Fund (ETF). It is a rand-based index tracker that tracks the S&P 500 index. The S&P 500 includes over 500 leading companies in the US on the stock exchange and captures approximately 80% coverage of available US market capitalisation.

Is there a minimum deposit amount into the offshore equity fund?

Yes, there is a minimum investment amount of R125 into the offshore fund per goal. Any contribution to the offshore equity fund that is less than that per goal will be invested in the local equity fund (Satrix Top 40 ETF).

For example, if you invest R500 and your investment strategy is Balanced (50% cash; 50% equity), R250 will go into the cash fund and the remaining R250 will be split 50/50 into the local and offshore equity funds (R125 respectively).

However, if you invest R500 and your investment strategy is Safe (80% cash; 20% equity), R400 will go into the cash fund and R100 will go into the local equity fund only, because if you had to split that amount 50/50, you would get only R50, which is less than the required R125 for the offshore equity fund.

What are the fees I need to pay on the offshore equity fund?

There are costs associated with investing in or withdrawing from the offshore equity fund. These are costs that are passed through from our service provider, on which Franc doesn’t make any profit.

Franc will ensure that the total fee you pay when you invest or withdraw will never be more than 0.76% of your investment or withdrawal amount (excluding any Franc withdrawal fees). This is made up of a brokerage fee (for a buy or sell), an investor protection fee, and an electronic settlement fee based on the volume of investments through Franc into the fund on that day.

Your percentage fee charged will likely be lower than 0.76%, but will be impacted by daily investing volumes, which will vary. Franc customers will also pay an annual 1% fee on money invested.

Why did my deposit into my offshore equity fund go into the local equity fund?

Our offshore equity fund (Sygnia Itrix S&P 500) has a minimum investment amount of R125 per goal, which means that any contribution into the offshore fund less than that per goal will be invested in the local equity fund.

What is the difference between the Satrix Top 40 ETF and the Sygnia Itrix S&P 500 ETF?

The Sygnia S&P 500 ETF tracks the performance of the S&P 500 index, which comprises over 500 of the largest U.S. companies, offering investors exposure to the US market and global economy.

In contrast, the Satrix Top 40 ETF replicates the JSE Top 40 Index, consisting of the 40 largest companies listed on the Johannesburg Stock Exchange, providing investors with exposure to the domestic South African equity market.

What is the tax involved in offshore equity fund?

You’re taxed on any capital gains (growth on your investment) that are over R40,000 annually across all investments, only if and when you withdraw or sell your investments. This isn’t exclusive to offshore investing.

Will I receive any dividends from the offshore equity fund?

Where possible, any dividends received will be used to buy further units in the fund (will be reinvested). If the dividend received is too small to buy further units, the dividend will be allocated to your Excess Cash account.

What is Excess Cash?

Our offshore equity fund (Sygnia Itrix S&P 500) has a minimum investment amount of R125 per goal, which means that any contribution less than that per goal will be invested in the local equity fund. If you invest the minimum amount of R125 or more per goal into the offshore equity fund, any portion of your contribution that doesn't buy whole units in the offshore equity fund (Sygnia Itrix S&P 500) will be directed to 'Excess Cash'.

How do I withdraw from Excess Cash?

You will be able to withdraw your Excess Cash balance when you make a withdrawal from your cash fund. In some cases when you withdraw from your offshore equity fund, part of your Excess Cash balance may be used to fulfill a portion of your withdrawal (so fewer units in the ETF need to be sold).

Will I earn interest in my Excess cash?

Yes, you will earn a market-related interest rate on any Excess Cash balance.

Why is my Excess Cash balance negative?

This is because the annual assets under management fee Franc has accrued for the specific month is more than your initial Excess Cash balance.

What are the risks in investing in the offshore equity fund?

The offshore (Sygnia Itrix S&P 500 ETF) equity fund carries some risk, which means there is a chance that you may lose some of your initial investment, especially if you are only invested for a short period of time.