Being young has its advantages. When you're 20 tendinitis gets better in a week, when you're 40 it takes a month, and when you're 60 you just learn to live with it. Youth is elastic and resilient.

This is as true for your savings as it is for your ligaments.

Young people sometimes think that saving and investing is for older people. Yeah, yeah, one day I'll have to think about retirement funding and that stuff, but that's for later – when I'm in my 30s or 40s.

It's a boring topic, after all.

So it may surprise you to learn that the best time to start saving is when you're really young.

"Warren Buffet, who is worth $75 billion dollars, bought his first shares when he was 11 years old. He wasn't born with a silver spoon, he had to make money – he was already walking around his neighbourhood selling cokes and gum when he was 6."

If you were born after 1990, the money you save now will probably be worth more than anything else you invest at any other point in your life. Don't believe us? Consider this quiz question.

Linda invests R40 a month from age 20 to age 30 (for 10 years) and then stops investing altogether (but leaves her investments to grow). Lingomso invests R40 a month from age 30 to age 65 – for 35 years. The question is, who ends up with the most money at age 65?

Surely it has to be Lingomso? Investing every month for 35 years must beat investing for only 10 years? But that's the wrong answer.

Such is the power of starting young that Linda – who invested for just 10 years and then spent 35 years not adding to her investment – has more money at 65 that Lingomso.

The numbers are impressive. We're assuming growth of 13% a year here, slightly below the actual long-term return of equities. (Over 40 years to end May 2020 the average annual rate of return of the JSE was actually 16.1% – we'll compare below).

- Over 35 years, R40 per month grows to about R340,000 (not bad for an outlay of only R16,800 – 420 months x R40).

- Over 10 years, R40 a month grows to almost R10,000. But here's the thing – R10,000 invested at 13% for 35 years, with nothing more added, grows to about R570,000.

Let's repeat this. Linda invests R40 per month for 10 years, Lingomso invests R40 per month for 35 years, but Linda ends up with R230,000 more money than Lingomso – R570,000 versus R340,000. All because of putting aside just R40 a month when she was young.

And the difference gets bigger as the rate of return increases. At 16.1% per annum Lingomso ends up with R800,000, but Linda ends up with R1.6 million – double Lingomso's return.

How do you make this happen for yourself?

- Download the Franc app from the Play Store or the App Store

- Do the risk assessment to see how much you should put into equities (if you're young and debt-free, aim for 100%)

- Keep investing, be patient, don't get too excited when the stock market goes up like a rocket, and don't panic when it goes down – that's how markets are

- Don't raid the piggy bank

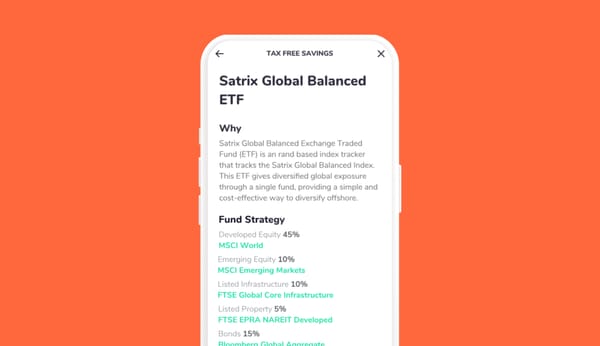

Franc uses the Satrix 40 ETF – a fund which tracks the JSE Top 40 index – to access the equity market.

This gives similar returns to the overall market (sometimes slightly better), so if history repeats itself you can look forward to double-digit returns over the decades.

You only have to look at Linda's investment balance to see what can happen to your money if you're disciplined and go the distance.

This article has been updated with examples using R40/month instead of R200/month – R40 in 1975 was the equivalent of about R1,800 in 2020 terms.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)