We’ve all received financial advice in some way or another. Whether that’s from a trained professional or your uncle at the braai (this might be the same person); we’ve heard some tips and predictions about where the next big thing will come from. Sometimes we follow through and reap all the benefits of that once-in-a-lifetime buy, but most of the time it doesn’t turn out as planned - especially when markets are as volatile as they have been during the past few years.

The skeptics among us will do their due diligence and find more research as soon as someone suggests a new company to follow or stock to sell, but most people are busy. The average person is strapped for time to do deep dives into all the financial statements and might not have the resources to get a financial advisor who can do it for them - which means taking advice from social media personalities, TV hosts, and financial journalists. This might not be a bad alternative when they’re trained, but considering the stakes aren’t as high as when they get a commission based on the performance of your portfolio, this advice might not be as well-researched as you should hope for it to be.

As humans, we’re all prone to mistakes, some small and some big, but when it comes to money, you should hope that those mistakes are few and far between. But when the advice you receive always lands you in the red, it just might be time to stop taking it. This is what happened in the case of Jim Cramer.

While not a traditional advisor, Jim Cramer is certainly someone people take financial advice from. So who is Jim Cramer? Jim Cramer is a former hedge fund manager, author of many financial books and the host of Mad Money with Jim Cramer - a show where he gives the audience a rundown of the latest movements in the stock market as well as his personal picks for stocks to buy, sell and keep. By all accounts, he is a very knowledgeable man with an impressive track record. But after a few bad picks, people started doubting his choices. So much so, that people started hypothetical debates on Twitter and Reddit about what it would look like to do the exact opposite of everything he says. In other words, if he advised you to buy a particular stock, you should just sell it instead.

What started as a thought experiment, gradually became something real. At first, people would use Index One (a public platform that allows you to create a stock index whose performance you can track) to see how viable it would be. By May 2022, the Inverse Cramer ETF started outperforming the S&P 500 Index and within just a few months, Tuttle Capital Management - notorious for their ETF that bets against Cathie Wood and is up 73% year-to-date - introduced an Inverse Cramer ETF that people can invest in.

Jim Cramer has since made better picks and it’s evident by the fact he is still on air and still has viewers, that people still listen to him (at least that is the hope). But again, he is just a person who can make just as many mistakes as you or I.

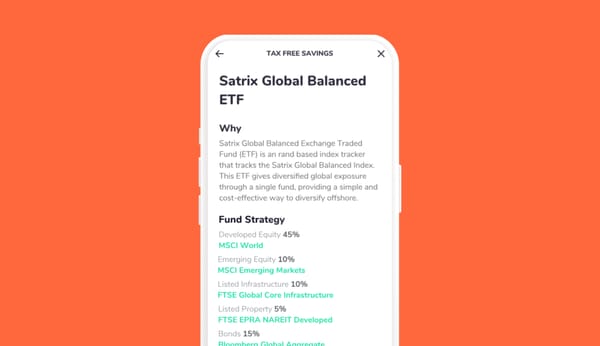

While the moral of the story is certainly not to do the exact opposite thing when you receive financial advice, it is worth being cautious when it comes to taking the advice (especially with higher-risk investments). Even the experts can get it wrong sometimes. This is why when you’re seeking advice, aim to get it from unbiased sources that have done all the necessary research. With Franc, you have access to a Robo-advisor that looks at your income, debt, savings and financial goals to give you the ideal investment based on your risk profile. This might not be as cool as the new rocket fuel company your cousin found, but it certainly won’t blow up in your face.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)