It’s clear by now that Bitcoin and other cryptocurrencies have captured the public imagination.

More and more people are seeing cryptocurrencies like Bitcoin as a viable and valid investment category, and laws now exist in many countries that govern the use and trading of these assets.

Crypto is becoming as accessible as other asset classes. In several countries, for example, you can now invest in Bitcoin and other cryptocurrencies via registered ETFs.

But if you’re still not sure what cryptocurrency and Bitcoin (really) are and how it works, then carry on reading: this is our beginner’s guide.

What is cryptocurrency?

Before we go more in-depth about Bitcoin, we need to understand cryptocurrency:

Cryptocurrency is a digital asset

Cryptocurrency is a virtual or digital currency, or asset, that you can buy, sell, and exchange. Unlike physical currency – like the rand or US dollar – cryptocurrency can only be bought, sold and exchanged virtually or digitally – there’s nothing physical like a note or coin you can actually see or touch.

Much like a normal currency, cryptocurrency has value because everyone agrees it has value – the actual asset itself isn’t worth anything without this agreement.

Another similarity is that there’s an element of scarcity that drives the value of the cryptocurrency. For example, there will only ever be 21 million Bitcoin, which is one of the reasons some people expect the price to rise over time, as more people want it, but there’s less to go around.

Crypto trade is recorded on a blockchain

For most cryptocurrencies, every time they are bought, sold or exchanged, these transactions are recorded on a decentralised public ledger, called a blockchain. This public ledger is like one big master spreadsheet.

What do we mean by decentralised? Nearly all governments around the world have central banks that control the supply of money in the market. It’s an important role because too much money can result in extreme inflation – think of hyperinflation in Zimbabwe in 2009 that forced the government to issue 100 billion dollar notes – and too little can stifle the economy.

In order to control money, governments define ‘legal tender’ and what commercial banks may and may not do. That means all normal currency is tied to and managed by these few organisations.

In the case of cryptocurrency, on the other hand, there are millions of people around the world that manage these transactions. In fact, absolutely anyone can have a copy of that ledger, or master spreadsheet, and help to manage it.

Of the millions of people that have a copy of the ledger on their computers, there’s software ensuring that each of these ledgers are accurate and the same as every other copy. This makes it harder for one person or organisation to control the ledger, and for transactions to be reversed, hacked or faked.

Encryption makes cryptocurrency secure

Each cryptocurrency transaction is encrypted, which means it’s converted from plaintext to ciphertext to make it unreadable. This helps to make these transactions and ownership secure.

If you own cryptocurrency directly, you’ll have a private key that you can store online or in a physical crypto key holder that will allow you to decrypt that information and verify that you are, in fact, the owner of that cryptocurrency.

A quick history of Bitcoin

Now let’s get into Bitcoin.

It’s thought that Satoshi Nakamoto (a pseudonym used by the real originator, or originators, who remain anonymous to this date) started developing the code for Bitcoin in 2007.

The first version of the software was released in January 2009, and in October 2010, Nakamoto published a white paper entitled Bitcoin: A peer-to-peer electronic cash system, which outlined the principles of a ‘distributed ledger’ that would not be controlled by any person or entity – something separate from governments and banks – which is now known as blockchain (described above).

Is Bitcoin a currency or asset?

In its early years, Bitcoin was touted as a future alternative to ‘fiat’ money (i.e. money issued by central banks). In reality, Bitcoin doesn’t function well as a means of payment.

The platform’s inability to process large numbers of transactions is one reason for scepticism around Bitcoin. Visa and Mastercard process about 5,000 transactions a second; Bitcoin about 7.

Self-evidently, Bitcoin is not going to replace fiat money anytime soon. However, it has become clear that crypto is seen by most holders as a store of value, not day-to-day currency.

In this way, Bitcoin can be better likened to gold. In the modern world, while gold is no longer a basis for currency, it remains widely prized as a safe haven, something that will hold its value in times of uncertainty.

While gold has historically established itself as a relatively stable store of value, Bitcoin has yet to prove that it can play a similar role.

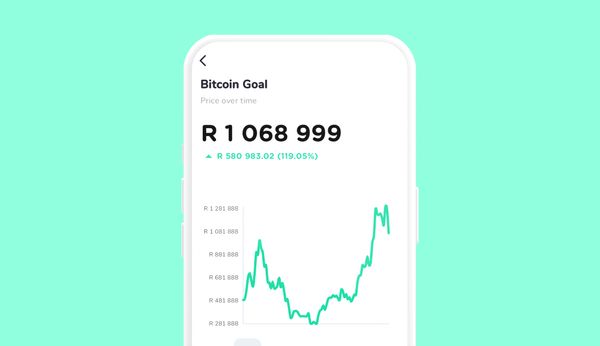

Not surprisingly given all the uncertainty around it, Bitcoin has been far more volatile than gold and other asset classes, fluctuating from time to time through jaw-dropping price swings. This makes it attractive to speculators; their actions tend to exacerbate the price movements.

What’s the future of Bitcoin?

As an increasingly regulated asset class, the general feeling is that crypto assets – and Bitcoin in particular – are here to stay.

Nobody really knows, however, what the future holds. The internet is full of wild price predictions that would have Bitcoin double or triple in anything from six months to a few years.

On the flip side, some people still see it as a bubble, although this view is increasingly strained. Having survived for well over a decade, Bitcoin is no longer the strange, unfamiliar entity it was in 2009 when the first block was mined.

Although there is no solid basis for massive price predictions – Bitcoin’s value is a function of sentiment (what people think about it) and sentiment is unpredictable – the continued hype around crypto is likely to maintain upward momentum for some time. Positive sentiment often feeds on itself and drives up prices.

There are risks, however. If authorities believe that monetary systems are threatened by crypto, gains could be stifled by regulatory frameworks. In China, for example, once the leader in Bitcoin mining, all crypto-related activities were declared illegal in 2021.