A tax-free savings account (TFSA) is an investment vehicle that allows South Africans to save significantly on tax when investing – at least, that’s if they use it right. Unfortunately, TFSAs have been notoriously badly marketed by financial institutions and as a result, misused by many South Africans.

That’s why, when we launched the Franc Tax-Free Savings Account in March 2025, we knew we needed to dispel some myths and set it up for the success we know our Franc investors could have. To do that, we needed to choose the very best fund for our investors to put their money in.

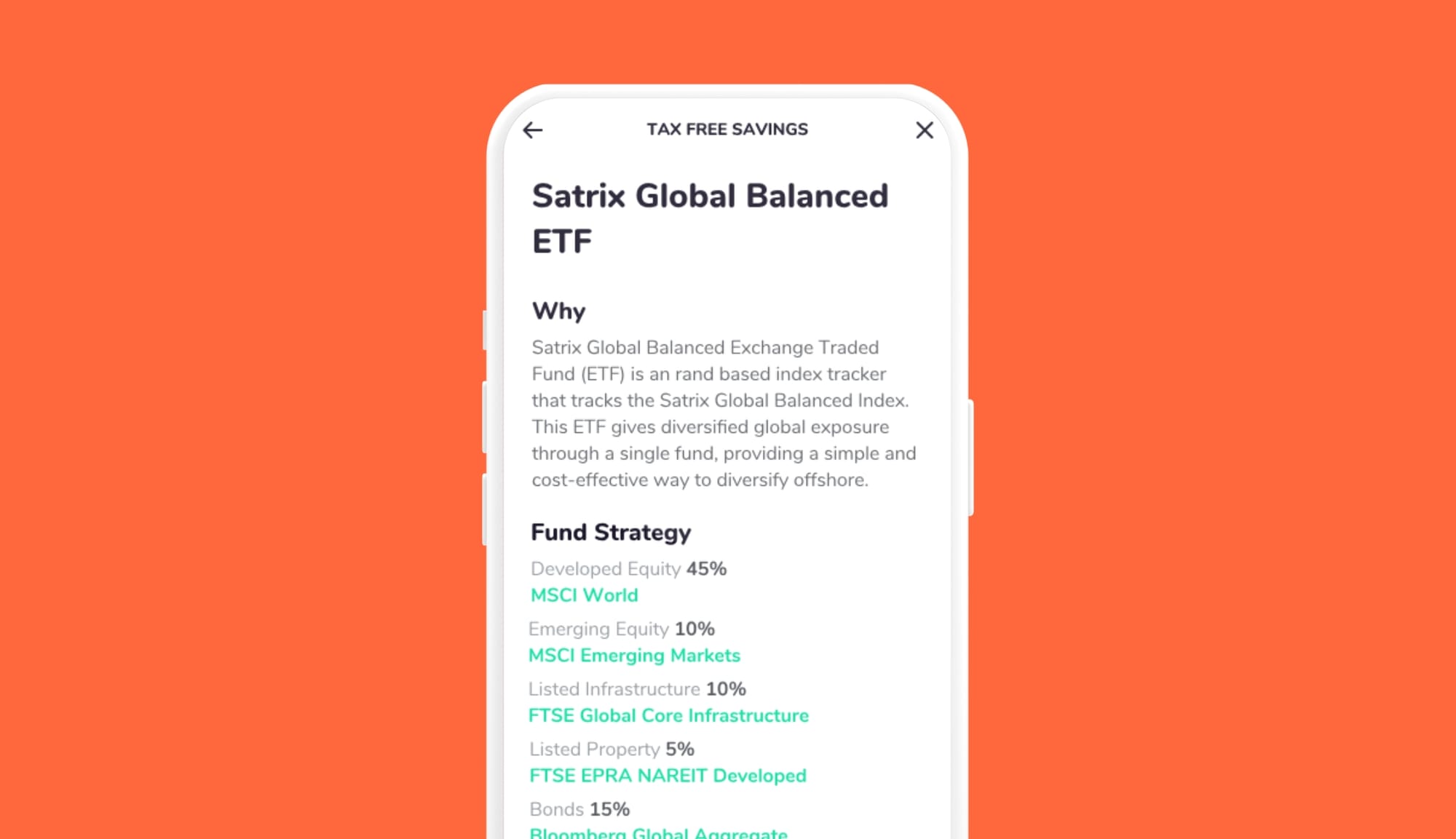

Introducing the Satrix Global Balanced Fund of Funds ETF: a super diversified, balanced fund that promises high, but smooth, growth potential.

What is a tax-free savings account?

A TFSA is an investment product that allows you to invest money into a fund or combination of funds without paying any tax on interest, capital gains or dividends – essentially, the growth on your investment.

Over time, this benefit can make a real difference. But that’s the key thing: it takes time, and a high-growth fund, to reap the rewards of a TFSA.

That’s because South Africans have a R23,800 interest exemption and R40,000 capital gains exemption every year. If you earn interest of less than R23,800 or make a capital gain of less than R40,000 in a tax year, you don’t owe SARS any taxes on these returns. So why would you invest in a money market TFSA if you probably weren’t going to pay tax anyway?

Let’s make that palpable through an example:

Say you invest R3,000 a month until your lifetime limit of R500,000 has been reached and hold your investment.

When the (almost) 14 years have passed, your total investment of R500,000 (assuming a 12% annual return) would now be worth just over R1.2m – reasonably impressive.

But see how much it would be worth if you kept it in for another 5 to 30 years:

Why we believe the Satrix Global Balanced FOF ETF is the best TFSA fund

Once we made the decision to launch a TFSA, the question was which fund was best to offer our Franc investors.

A great TFSA fund needs to:

- Have great long-term growth potential

- Be very diversified

- Ideally be a global product

- Not be too volatile

- Be affordable

When we saw Satrix was launching their Global Balanced Fund of Funds ETF (the first global balanced ETF listed on the Johannesburg Stock Exchange), we knew we had found an ideal TFSA fund solution for our customers.

This fund tracks a diversified blend of global indices representing different asset classes including equities, bonds, inflation-linked bonds, listed infrastructure, listed property, credit, and cash. It’s called a Fund of Funds because although it itself is a single fund, it comprises a number of other different funds as the underlying investments (which then comprise a number of different assets or products).

How does the Satrix Global Balanced Fund of Funds ETF perform?

Although the fund itself didn’t exist until recently – so there’s no historical data to look at – you can calculate what the returns would have been using the performance of the underlying benchmarks (see the table below).

Based on that, this fund would have returned just under 12% annually (in rands) over the past 3 and 5 years to January 2025 (beating inflation substantially).

Being diversified is important as one of the benefits is that the fund is less volatile (fewer ups and downs while you’re investing). We want our customers to be able to benefit from long-term growth potential, but have a relatively smooth ride at the same time.

One way to measure the risk or volatility of a product compared with another is to look at its standard deviation. If you analysed the standard deviation of the Satrix Global Balanced Index from December 2006 to January 2025 it comes out at 11.68% versus the 16% of the MSCI World index over the same time period.

The MSCI World index also had a maximum drawdown (when something falls in price) of 54% vs the Satrix Global Balanced Index maximum drawdown of 39.9%. Both these comparisons show the benefits of diversification: lower volatility and fewer wild swings.

Be careful what you invest in

TFSAs are a great product to maximise your investment growth potential and save on tax – if used the right way. Invest in a high-growth fund like the Satrix Global Balanced Fund of Funds ETF for the long term, and you’re well on your way to a comfortable retirement.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)