Assets aren’t the only thing successful investors invest in.

Years of grinding away make up part of the puzzle, sure, but it isn’t the only ingredient needed for investing successfully and staying wealthy.

Take Warren Buffett. The US mogul is one of the best known investors in the world. In several interviews, he’s also revealed himself as one of the best read investors, dedicating an impressive six hours daily to reading.

“I read and think. So, I do more reading and thinking and make fewer impulse decisions than most people in business,” he’s shared.

Like Buffett, the Franc team are hungry to learn about all things money and investing, which is why we invest in reading about it, too.

Here are our best recommendations for books about money and investing, to kickstart – or supercharge – your investing journey. 🚀

- ‘The Snowball: Warren Buffett and the Business of Life’ by Alice Schroeder

- ‘Manage Your Money Like a F*cking Grown Up’ by Sam Beckbessinger

- ‘What’s Your Move?’ By Nicolette Mashile

- ‘The Psychology of Money’ by Morgan Housel

- ‘The Wealth Chef’ by Ann Wilson

- ‘You’re Not Broke, You’re Pre-Rich’ by Mapalo Makhu

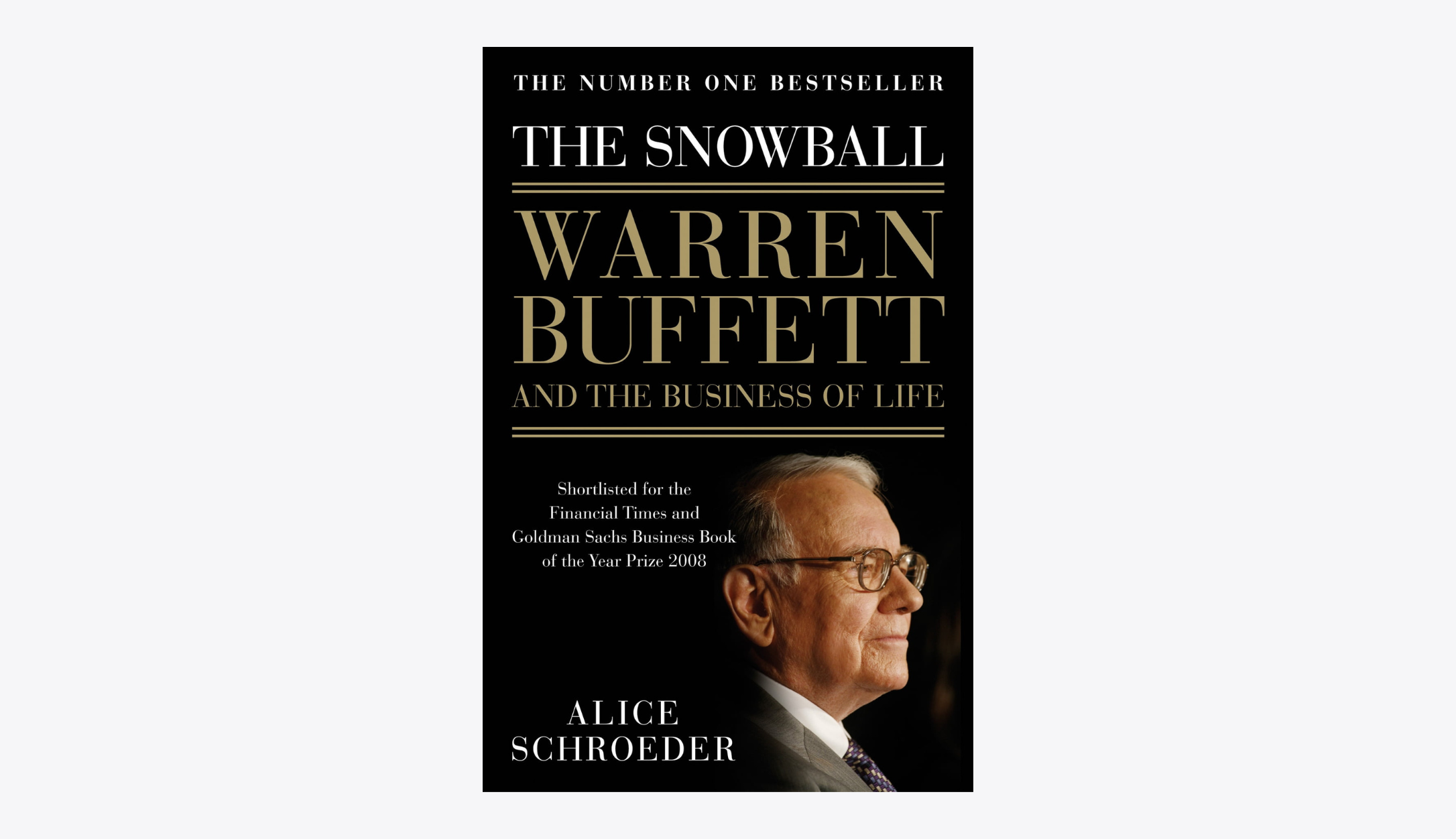

1. The Snowball: Warren Buffett and the Business of Life

By Alice Schroeder

Recommended by Thomas Brennan, CEO at Franc

In this biography, insurance industry analyst and writer Alice Schroeder was granted unprecedented access to Buffett’s ‘inner circle’: his wife, children, friends and business associates, as well as a chance to explore his larger philosophy on life.

Investing aside, get a first-account view on topics such as trade-offs of various forms of success, understanding your purpose and priorities, and the importance of relationships. 🤝

Read it to… Understand what principles and values made Warren the huge investment success he is.

2. Manage Your Money Like a F*cking Grown Up

By Sam Beckbessinger

Recommended by David Chang, Data Analyst at Franc

The blurb of this bestseller pretty much says it all: “The Best Money Advice You Never Got”.

Written like a chat with a straight-talking friend, this how-to guide walks you through everything from budgeting and being credit-smart, to negotiating a raise, and “trick[ing] your dumb brain into saving more, without giving up fun”. 💃

Sam is a South African author who was involved in the 22Seven budgeting app in the early days, so she’s been around the local block and has a thing or two to share!

Read it to… “...take control of your money to take control of your life.” 🙌

3. What’s Your Move?

By Nicolette Mashile

Recommended by Cassidy Nydahl, Head of Growth at Franc

Friend of Franc Nicolette Mashile, aka the Financial Bunny, bares all in this part autobiography, part exposé (of all her biggest money mistakes!). Nicolette holds a mirror up to her own financial mishaps on her journey to becoming an internationally-recognised advocate for financial literacy, so that you can learn a lesson or two in the process.

After each chapter, she challenges readers to apply these learnings to take control of their own financial destiny.

Read it to… Make the step change from financial literacy to smart application. ✅

4. The Psychology of Money

By Morgan Housel

Recommended by Sebastian Patel, COO at Franc

Why do really smart people still make bad money decisions? That’s what Morgan Housel tries to uncover, and in the process he shares 19 real stories to explain how it’s not what we know, it’s how we behave. Here are some faves: ‘Man in the Car Paradox: No one is impressed with your possessions as much as you are,’ ‘You & Me: Beware taking financial cues from people playing a different game than you are,’ and ‘Confounding Compounding : $81.5 billion of Warren Buffett's $84.5 billion net worth came after his 65th birthday.’

And then he goes one step further: by breaking down the psychology and thought patterns that influence your behaviour.

If you’ve often wondered why you can never stick to your savings goals or why you’re not having much luck on the stock market, this is a must-read.

Read it to… Understand what makes influences yours and other people's behaviour when it comes to money and investing.

5. The Wealth Chef

By Ann Wilson

Recommended by Nic Oldert, investment specialist & consultant to Franc

Ever heard the phrase, “you’ve worked hard for your money, now make it work hard for you”? Great in principle, but where do you start?

International financial coach Ann Wilson has dedicated years to helping millionaires ‘cook up’ monetary success. Through this guide, find out how she does it.

Exploring how to knock down your wealth-diminishers (debt), set up your wealth creators, and still enjoy your quality of life while reducing expenses, she uses five ‘recipes for wealth’ to share her secrets.

Read it to… Be inspired to work towards your financial freedom, right now.

6. You’re not Broke, You’re Pre-Rich

By Mapalo Makhu

Recommended by Anelisa Maswana, Associate Product Manager at Franc

Founder of the platform Woman & Finance, Mapalo Makhu has pearls of wisdom to share from her journey to the top.

Black tax, retirement saving, purchasing a car, insurance… Name a South African financial reality, and it is covered in this book that helps you #liveyourbestlife.

Read it to… Get local wisdom to get (and stay) out of debt, invest and be savvy in your everyday financial decisions.

3 Other Ways to Switch Up Your Learning

While books are fantastic for gaining a rich understanding of topics you’re interested in, diversify your investment knowledge with these resources:

1. Follow finfluencers on social 📲

It’s always refreshing and insightful to get short, snappy financial hacks from real people going through the same challenges as you. Get your dose of financial education and entertainment all in one by giving these guys a follow to get started.

2. Expand your knowledge through Franc Academy 🎓

Whether you’re just getting started, or want to add to your growing financial knowledge (go you!), the online lessons in Franc Academy bring you closer to your goals.

3. Learn as you go 💪

Rushing takes the joy and understanding out of learning, so take it at your own pace. When you download the Franc App and invest, you can always expect to feel in charge of your choices, being guided through the process step-by-step.