Many South Africans live day to day, week to week or month to month - from one paycheck to the next without putting money away for a rainy day. This is all well and good when things go as planned, but we all know that life has a habit of throwing us a curveball when we least expect it.

An emergency fund is essential in order to pay for these unexpected expenses.

What’s worse than an unexpected expense? No income!

The current 5 week lockdown in SA has meant that many businesses that are deemed to be non-essential have been shut down. I have the ability to write this article and perform my other daily functions as COO of Franc from home, but many are not that lucky. Those that work in restaurants and coffee shops or are hairdressers or mechanics cannot do their jobs and in many cases are not earning any money as they were reliant on paying customers for most, if not all their income. Many of their expenses (food, rent, cellphone, DSTV) still need to be paid but where are they finding money from?

Some stats

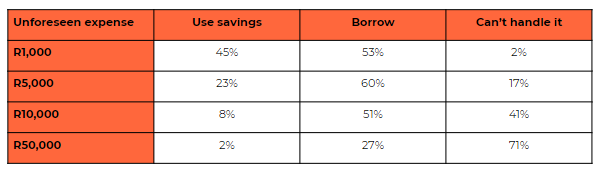

The 2019 Old Mutual Savings and Investment Monitor showed the responses of 1,000 South Africans with a range of household incomes from less than R6,000 to more than R40,000 a month. The table below is an extract from this report and shows the percentage of households that could pay for an unexpected expense from savings (with the alternatives being borrowing the money or not being able to handle such an expense).

Only 23% of households could pay for an unforeseen expense of R5,000 from their savings whilst only 8% could pay for an unforeseen expense of R10,000 from savings. It is important to note that 22% of the households interviewed were earning more than R40,000 a month, so many of them also do not have R10,000 in savings. A large proportion of those interviewed had to borrow in order to cover these expenses and in many cases they would be increasing their already high indebtedness level.

What is an emergency fund and how do I make it happen?

A fund for emergencies! We recommend to our investors to try have 3-6 months of expenses saved away in a high interest bearing cash account which is easily accessible and earning an inflation beating return (unfortunately bank savings accounts pay very little interest and you will not earn anything on that money under your mattress). So if your monthly expenses are R10,000 on average - aim for R30,000-60,000. This seems like a lot and is, but is attainable with consistent saving. If you save R1,250 a month it will take you under 2 years to get to R30,000 and just over 3 and a half years to get to R60,000 if you are able to earn a 6.5% return per year in a cash fund. Importantly, if you can afford to add in extra sometimes, you should do so.

This is meant to cover you for when you have that unexpected accident and need to pay an insurance excess, or for a new set of tyres or worst case if you are not earning any income as many people are currently. It’s not meant for that Mauritius holiday you have always wanted to take, you need to save separately for that!

If you are one of the lucky ones that is still earning their normal income through this lockdown period, you are most probably spending less given the opportunities to spend at traditional shops and restaurants are not there. Take advantage of this and start saving towards your emergency fund now if you don’t have one so that you can hit that curveball out of the park.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)