There is an ancient story where someone requests an unusual reward from a king - instead of gold coins, he asks for rice. “Give me one grain of rice on the first square of this chessboard, then two grains on the second square, four grains on the third square, eight grains on the fourth square and so on so that each square contains double the amount of rice of the previous square”.

What would you say to that request? Well a chessboard has 64 individual squares - on the 8th square there should be 128 grains of rice, on the 16th square just under 33,000, on the 24th square there would be 8.4 million grains of rice and at the halfway point on the 32nd square there would be 2.1 billion grains of rice! This is the power of compound (or exponential) growth.

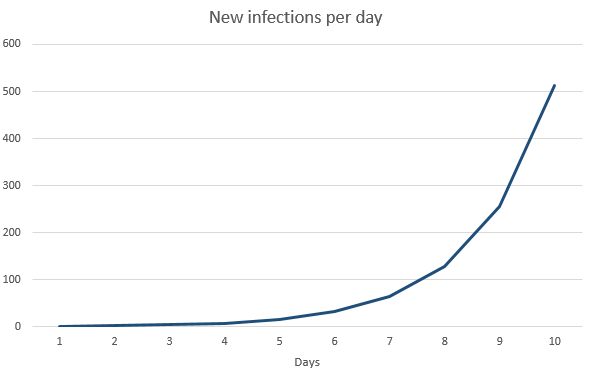

We are all living in a world hugely impacted by COVID-19 (aka coronavirus). Not so long ago it was something we may have heard about, but it wasn’t the threat it is now. Again exponential growth is the reason for its rapid progression. If we estimate that every infected person makes 2 people sick a day, the rate of new infections follows the rice on the chessboard - 2 will make 4 new people sick, 4 will make 8 new people sick and so on. Very quickly we are in a scenario where without lifestyle changes, hundreds of thousands of people are infected.

What has this got to do with investing? Well if you are patient, you can benefit from the power of compound growth.

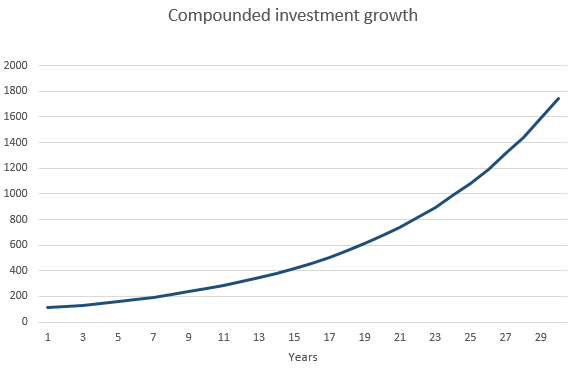

If you invest R100 into an investment account that grows 10% per year, at the end of the first year you will have R110 in that account (your initial R100 plus R10 of growth). If you keep the R110 in the account and the growth is the same, at the end of the second year you will have R121 in the account (R110 plus R11 of growth). In the second year your growth was higher because it was based off your initial R100 deposit as well as the R10 earned in the first year – growth on growth!

The power of what “growth on growth” does to your investment over time is simply incredible. If you kept the R100 in the investment account over ten years your balance would be just under R260. So your investment grew by R160. If you remained invested over 20 years you’d have more than R670 and after 30 years you’d have R1,745!

The most important aspect of compound growth is time. The earlier you start investing, the more time you give compound growth to work its magic. It’s also important to stick to your investment plan and not withdraw in order to give your money the best chance to grow.