A well-managed budget plan can be the key to helping you control your spending (and saving) and reaching your goals for the future. Here’s the 3-step formula for setting up a budget for success, and how to maintain it so it actually works for you.

How to make a budget plan in 3 easy steps

Step #1: Calculate your net income 🔢

Your total net income is the total salary and any other income streams you have, minus any of the deductions or company contributions. If you handle your finances alone, this will only include your personal income. If you want to manage your finances as a family or household, you'll be calculating your combined income.

Your net income will be slightly different if you’re employed or self-employed:

How to calculate net income if you’re employed:

If you work for a South African employer, your net income is the cash amount you receive in your account on payday.

It’s calculated as:

(Total cost to company) – (total deductions + contributions + fringe benefits) = net pay

Your total cost to company would include your basic salary and any bonuses, commission, or overtime, as well as various deductions and non-cash contributions that your employer pays on your behalf before it’s paid to you.

Here are some examples of deductions vs company contributions:

If your employer offers fringe benefits, too – like meals – this would also be part of your total cost to company.

Luckily, your employer should lay this all out in your payslip, where you can easily find your net income every month.

How to calculate net income if you’re self-employed or a freelancer:

If you’re a freelancer, you’ll likely be paying provisional tax once or twice a year. To make sure you have enough to settle your tax bill come SARS filing, tax consultants recommend saving or investing 25% of your income received every month.

Here’s a simple way of understanding your net income as a freelancer:

(Total invoiced income received) X 75% = net income*

Step #2: Track your spending 🔍

Where does all your money go every month, and why do you never have enough left over to save and invest? These are the questions you’ll likely answer when you start accurately tracking your spending.

To budget effectively, not only should you include planned income and expenses for the future, but also actual income and spending in the past to help you know what your current spending habits look like.

Once you know that, and which of those expenses are set (fixed), or which can be reduced or removed completely (variable), you can start to find extra cash to save towards short- and long-term goals.

Here’s how to identify fixed vs. variable expenses

How to go about tracking your spending

- Download our budget sheet template and gather 3-6 months’ bank statements.

- For each month, create a column and fill in the actual spend for that month under each of the categories that apply to you (like entertainment, rent, vehicle or insurance).

- Create 3-6 more columns – one for each new month – after these, where you’ll use the ‘actual’ numbers to roughly budget spending for the upcoming months.

Step #3: Set your financial goals 🥅

Here comes the exciting part. 🤩

Now that you know what your income and spending actually looks like, and how you can adjust it to help save and invest more every month, you can start planning what you’re saving and investing that money for.

This is where you define what your goals are, and work out how much they’re going to cost. That way, you can start to adjust your spending accordingly.

What kind of goals should you be saving and investing for?

Your financial goals are any big plans for the future you’ll need a significant amount of money for. Saving and investing for goals as opposed to just because helps you stay motivated and dedicated to your savings and investing habits.

Here’s a quick goals timeline refresher:

- Short-term goals: 1-3 years. Think: weddings, education, or holidays.

- Medium-term goals: 4-10 years. Think: a property deposit or tertiary studies for kids.

- Long-term goals: 10+ years (often decades). Think: retirement.

Be realistic about how long it would take to save towards your goal, and how much you would need to set aside in your monthly budget to reach it.

Is there a guideline for how much you should be spending, saving and investing?

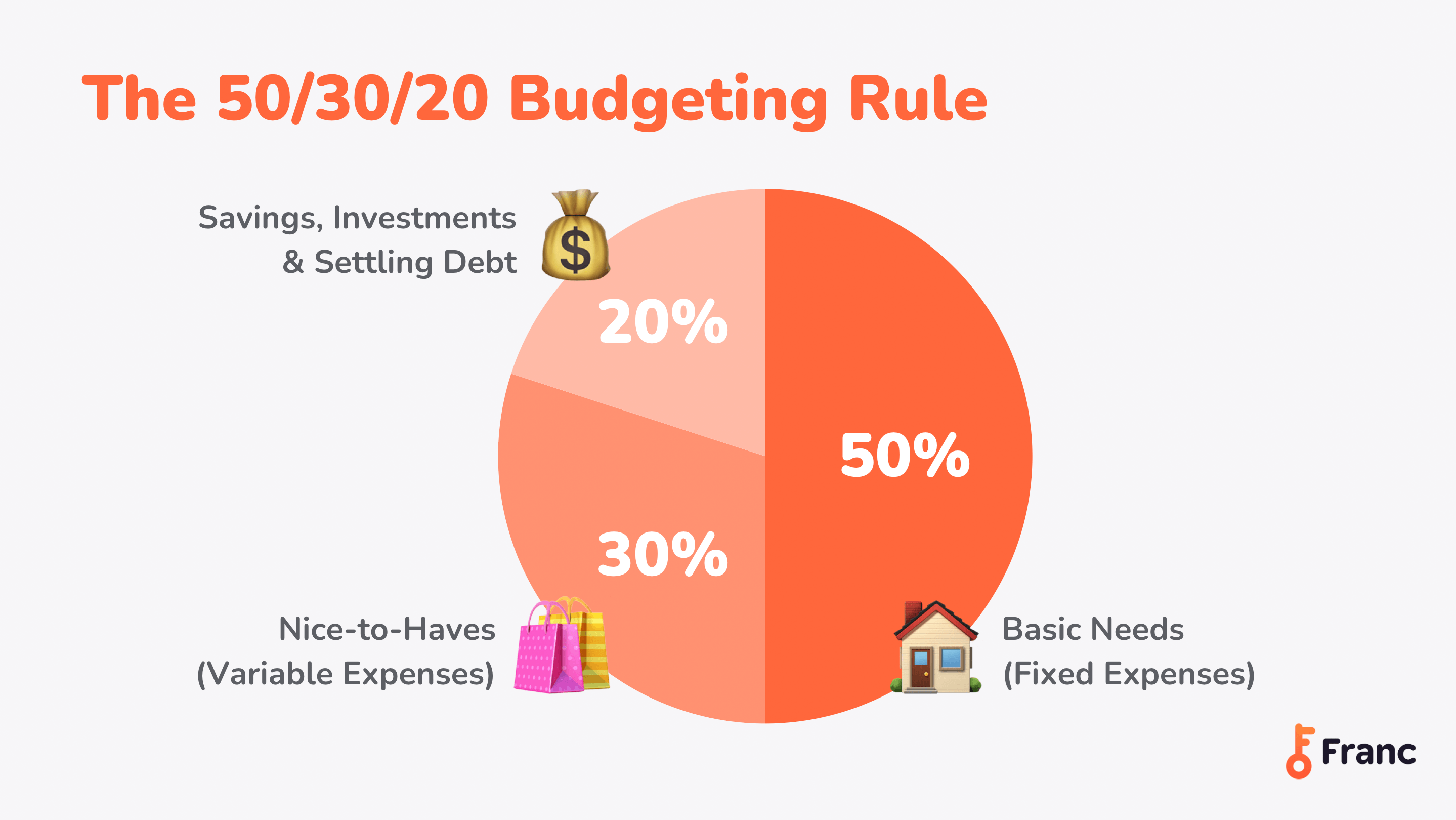

Whether you have a specific goal you’re saving and investing to or not, many financial fundis swear by the basic 50/30/20 budgeting rule that everyone should follow:

The 50/30/20 budgeting guideline was made famous by author and senior US senator Elizabeth Warren and helps you divide up your net income into 3 categories:

🛏️ Fixed expenses: all your basic needs (50%)

- Housing

- Groceries

- Electricity, rates & water

- Insurance

- Family and education

🧳 Variable expenses: nice-to-haves (30%)

- Dining out

- Shopping

- Streaming

- Entertainment

💳 Savings, investing or settling debt (20%)

- Emergency fund

- Retirement

- Paying off credit cards or other debt

How to maintain your budget

Your budget plan shouldn’t be a once-off tool or document you shelve away until you get your next pay increase.

Treat it as a tool for monitoring your spending as your income fluctuates, expenses change or goals evolve, and for finding new ways to save and invest a little more towards your goals.

Your checklist for reviewing & planning your budget every month:

- What did you spend? Categorise your expenses as either fixed or variable, or ‘needs’ or ‘wants’ – it’ll help big time when you want to review your spending and reduce it in places.

- What can you save on? Scan your variable or ‘wants’ expenses (those nice-to-have coffees and drinks), and reduce these items in your next month’s budget to free up some cash for saving and investing towards your goals.

- What debt can you knock off? The sooner you can knock that grudge line item off your budget completely, the sooner you can put that cash towards something that excites you and that you can feel good about spending on.

- How are you tracking on your goals? Check in on your goals and take note of your progress. Celebrate small wins towards achieving them, and assess whether your goals still make sense to you.

🔖 Need further inspo? Give these a read…

How To Start a Financial Planning Bullet Journal [+ printable template]

Step-by-Step Guide to Your First Budget

What You Can Learn From the Budget Speech

![How to Make a Budget Plan in 3 Steps [+budget sheet template]](/blog/content/images/size/w2000/2024/02/Budgeting-and-counting-out-money.png)

![The Guide To Provisional Tax In South Africa [+ downloadable provisional tax calculator]](/blog/content/images/size/w600/2025/09/calculating-your-provisional-tax.png)