An investment portfolio shouldn’t be complicated or overwhelm you. Yet it’s perhaps the most important financial aspect of life that is often overlooked. In this article, I find out from Mikhail Muller, a financial advisor who has been giving clients investment advice for many years, about investment strategies and what to consider when putting together an investment portfolio.

Key blog takeaways

💼 An investment portfolio is a collection of investments that may include multiple asset classes, such as shares, ETFs, cash and property (both local and potentially even offshore).

💼 Your portfolio should reflect the different investment goals you have, such as retirement, buying a new house or educating your children.

💼 Your risk tolerance is influenced by your current personal finances, your investment time horizon, how much you know about investing and managing money, and your personality.

💼 Your risk tolerance should inform the investment strategy, in other words what assets you choose to invest in.

💼 Your investment goals and the associated investment strategy should be reviewed regularly over time.

What is an investment portfolio?

Simply put, your investment portfolio refers to all of your investments. Your portfolio may include a variety of different investments, from property, to shares, to cash, bonds or exchange-traded funds. It would also include any tax-structured investments like your retirement annuity or provident fund – basically all your investments under one umbrella.

Building an investment portfolio might seem intimidating, but there are steps you can take to make the process manageable and less intimidating, regardless of whether you want to be very hands-on in your portfolio management, or completely hands-off.

Even if you choose to outsource the task to a financial advisor, who will manage your assets for you, it’s important to know the principles and steps involved:

Understand your risk tolerance

One of the most important things to consider when creating a portfolio is your personal risk tolerance. Your risk tolerance is your ability to accept temporary investment losses in exchange for the possibility of earning higher investment returns over the long term.

Your risk tolerance is influenced by your income, your expenses and outstanding debts as well as your existing investments. It should also be informed by how much time you have before you need to liquidate your investment, as well as how you cope with watching the value of the markets (and your investments) rise and fall.

A common rule of thumb suggests subtracting your age from 100 to determine what portion of your portfolio should be dedicated to equity investments. For example, if you’re 30, then 70% of your portfolio should be allocated to equity, leaving 30% of your portfolio for lower risk investments. In your 60s, that mix shifts to 40% allocated to equity and 60% to lower risk investments.

💡Mikhail’s Pro Tip: “I always recommend to my clients that are 25, 30, maybe even 35 that your risk tolerance should be a lot higher, because you have a longer period of being exposed to the market.”

Financial goals and their time horizons

We all have financial goals in life, and these change with age. When you were young, your financial goal might have been buying a new bicycle with the pocket money you’d saved up. As a student, it might be buying a nice gift for your partner. When you start work, it might be buying a new car or buying an apartment.

Some goals are short term, like saving up for a holiday at the end of the year, whilst others are long term, like saving for your retirement. This is often referred to as a goal’s ‘time horizon’ and will significantly impact the investment strategy that is best suited for that investment goal. A rough guide is the longer the time horizon, the more investment risk you should be able to take on board.

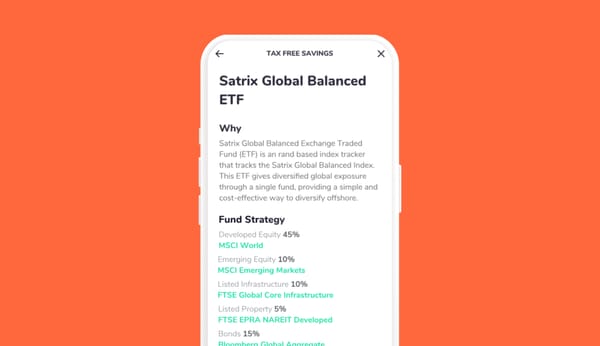

An investment strategy is how you split up your investments among different types of assets (sometimes called asset allocation). Keeping it simple works best, like splitting your investments between cash investments (very low risk) or index-tracking ETFs (moderate to high risk). On the Franc app, we use a risk profile quiz and time horizon to define Very Safe, Safe, Balanced and Bold strategies, which range from a mix of 0% equity and 100% cash, to 100% equity and 0% cash investments.

How to build an investment portfolio

1. Know yourself

The best place to start is an honest assessment of your personal finances, including your income, expenses, outstanding debt and current investments. You can then build on this with a better understanding of your risk tolerance.

❓You can use our quick online investment risk quiz as a starting point to your journey in understanding what your risk tolerance is and what type of investor you are.

2. Define your goals

List out all the financial goals that are important to you, from most important to least. Next to each goal, define its time horizon in years, e.g. retirement in 30 years.

I’d recommend putting retirement at the top, as most people don’t and therefore fail to adequately prepare for retirement. (It’s much easier to start small and early than wait until later in life and get a nasty shock.)

💡Mikhail’s Pro Tip: “You need to cover the inevitable things that are going to happen first. For example, you know for a fact that when you turn 65, you would like to retire. Then you can always keep your other goals aligned with what your needs are.”

3. Choose an investment strategy for each goal

Once you’ve got your list of goals and their time horizons, you’re in a position to choose a strategy for each goal. Generally if your goal’s time horizon is less than 3 years, you shouldn’t expose yourself to investment risk (ie. invest in cash); if your horizon is longer than 5 years, then you should look at equity investments in line with your risk tolerance.

4. Create your portfolio

To build an investment portfolio, you’ll need an investment account. You can open an investment account with Franc in less than 2 minutes. You can then create all your investment goals with the associated investment strategy and make an in-app deposit to start your investment portfolio today.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)