Did you know that you could retire at 35, or 40 or whenever you want? I know you might not believe me right now, especially since the retirement age of an average South African sits at 60 according to Trading Economics. The F.I.R.E (Financial Independence Retire Early) movement is fueled by people who want to challenge this statistic by retiring a lot earlier. They are able to live off the passive income of their investments. In this article I will explain the stages you could go through and maybe even show you that you could do it.

Stage 1: Choose your F.I.R.E lifestyle and goal

Just because you’ll be "retired" doesn’t mean you’ll never work again. It just means you’ll never need to work to afford your living expenses or deal with a boss yelling at you. Yes please! Plus why else did you free up all your time if not to work on a passion project? That’s why you should decide exactly what kind of lifestyle you want to live after you’ve achieved F.I.R.E. This will also help you determine your goal amount and set priorities that will help you make the tough decisions in the stages that follow.

There are no set lifestyles to choose from, each individual embarking on their F.I.R.E journey will need to determine what it is they can’t live without. It can range from really extreme savings which results in a strict frugal lifestyle. For example - ending your gym membership and working out in a park. In this case you will reach your goal sooner because you’ll be investing more. Also - how much you need to save will be less due to the super frugal lifestyle you are used to living, assuming you are OK to do that forever! But for those who like nice things you could always choose a softer lifestyle, this just means you’ll have to save and invest longer. This means you can keep your gym membership, but you will be working for your corporate overlords an extra couple of years. Another option is to only save for your base expenses and continue to work part-time for all the extras. This would be a good option for those who want to travel. So, once you have enough to retire, all the extra money you earn can go towards traveling!

Once you’ve decided what type of lifestyle you want you can use the 4% rule to figure out how much you actually need to have to retire. This rule states that you should be able to withdraw 4% of your investments each year and not run out of money. So if your expenses are currently R20,000 a month (R240,000 a year), you need R6m in order to retire. That's a big number but the sooner you start investing, the quicker you can get there.

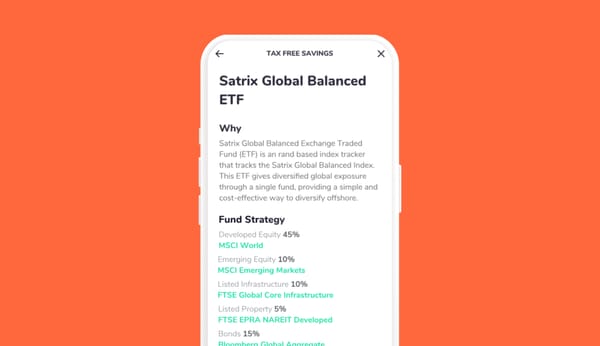

Another vital thing to consider is where you are going to keep all this money. For example, Franc is a safe-place to leave a stack of cash and know that it is working for you. The long term growth of your money should replenish what you take out and will even allow you to keep up with inflation if your investments are structured properly. You should also decide what age you plan to retire so you can work backwards to understand how much you need to save each month.

Stage 2: Cut down your expenses

So now that you have your goal it’s time to figure out exactly how you are going to get there. At this stage it’s time to relook at your budget, or possibly start one if you haven’t yet. You can check out this article for a guide on budgeting. One of the first things you should be doing here is making a plan to pay off all of your debt. The sooner you do, the less interest you’ll have to pay. That's one of the best expense cutting measures.

When it comes to the rest of your budget, how much you cut will depend on the lifestyle you chose. A good general rule to stick to when making your decision is only pay for the things you love. Remember the more luxuries you decide to maintain the longer it will take you to reach your goal, but on the other hand it’s no good getting to your goal and being miserable so you need to find the balance.

Stage 3: Increase your income

Of course you can only decrease your expenses so much. After that you’ll want to look for ways to increase your income to help you achieve your goal quicker. Your passive income will be increasing naturally the more you invest; so I’m talking about getting yourself a side hustle. It’s 2021, so the hardest part about this will be choosing between all of the side-hustle options. Uber driver, blogger, becoming an influencer, starting an ecommerce store, dog walking, baking or cooking, the options are endless. Heck, even if you're not interested in the F.I.R.E lifestyle, a side-hustle is still a must. 2020 has taught us you never know when there will be an event which will cause major job losses and everyone needs an emergency fund.

Stage 4: Stick to the plan and achieve ✨financial independence✨

Once you’ve gotten to this stage all that’s left to do is execute your plan and enjoy the journey. Reaching your goal is not going to happen overnight, as with any goal it’s important to set sub-goals along the way. It’ll help you to stop and celebrate all the progress you made. For example if you have a lot of debt the day you pay it all off is definitely a cause for celebration. There’s also when your investment portfolio reaches 7 figures. Just because you’re being frugal doesn’t mean you can’t stop and have a mini-dance party to celebrate.

So there you have it. A lot of people think of retiring early as an impossible dream. However, the F.I.R.E movement shows that with a little tweak to how we think about retirement, some planning and a bit of restraint it can become a reality. I know after learning all of this I definitely considered planning an early retirement full of travelling and creating art. What would you do if you retired early?

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)