Whether you’ve previously resolved to build up your emergency fund, save up enough to go on that epic summer holiday, or set aside 20% of your income into investments (as per the 50/30/20 budgeting rule), I’m going to bet that at least a third of those goals haven’t been stuck to… and are barely remembered.

At least, that’s where I was when I saw one of the latest Instagram Reels from Talya of Fashionably Financial about doing a financial reset:

Knowing how much I’d slipped on my resolutions, and taking a few cues and inspiration from Talya’s approach, I designed a financial reset journal and a 4-step process for checking in on, evaluating and resetting your goals for the year.

It was such a good exercise to do, and really helped to set my intentions – whether that was at the beginning of the year when I was setting my new year’s resolutions, or in the middle of the year when I was checking in on them.

So first you might be asking yourself:

Why should I do a financial reset?

We talk a lot about the power of investing towards your goals at Franc. According to our CEO and co-founder, Thomas Brennan, “Goal-based investing is different to traditional investing in that success is measured by how well you’re able to meet your personal life goals, not how well your investments outperform the market average.”

Goal-based investing integrates life and finances into a holistic whole, putting the emphasis on your money working hard for you, and not the other way around.

But let’s be honest: If you don’t have a daily or weekly reminder of what you want to achieve, it’s easy for your goals to get lost along the way, or fall off completely. And as situations and life changes over time, goals change too.

So that’s what a financial reset is for: to remind yourself of what you wanted to achieve, adjust your targets to get back on track, or update your goals to better reflect where you’re at in your life.

And my favourite part? As Talya says in her Reel, it’s also about celebrating the wins you’ve gained since you set your goals.

Cassidy and Anelisa chat about what they learnt from their financial resets.

The 4-step financial reset

Step 1: Refresh your memory on what you wanted to achieve

First, let’s start by finding those finance-related goals you originally mapped out. I had to scour through my Apple Notes, daily journals and all the pieces of paper stacked on my desk before I eventually found mine.

As you go over your goals, give each of them a score out of five based on the following questions:

- How relevant is this goal to me and my life situation right now?

- How important is this goal in the greater scheme of my year and life?

- How urgent is it that I achieve this goal?

- How much progress have I made in achieving this goal?

Tally the goal scores up. The financial goals that score the highest are likely your priority goals and are still very relevant to you. Those that score very low have either become irrelevant, or can be put on the back-burner while you refocus your attention.

Using the scoring system, I crossed a few goals off, chose my three most important goals, and wrote them down on a piece of paper to stick up next to my bed so I could be reminded of them every day.

Step 2: Check in on progress towards your goals

Now that you’re very clear on what your priorities are, check in on whether you’re “putting your money where your goals are”.

Using the Investments & Savings tab of the downloadable Personal Budget Plan template, map out all your investment goals and funds, what your target is, and how much you’ve been contributing to each of them over the months.

Once you’ve mapped out your savings and investments, ask yourself these questions:

- Do some of your investment goals not have targets? (We recommend having a realistic target to aim towards.)

- For those that do, how close are you to achieving your target?

- Do you need to redistribute your monthly contributions now that you’ve reprioritised your goals?

Consider this your reality check. Goals are all good and well, but if you’re not actively working, saving or investing towards them, they’re going to stay firmly on the page and not materialise in reality.

But also, I’m going to repeat what Talya said: don’t just pick apart the months or funds you undersaved on. Celebrate the wins as well! Even if you only saved R100 a month into your emergency fund on Franc, that money now has the opportunity to grow.

Step 3: Look back at how you spent your money the last 6 months

Bear with me: this is the least fun step in the process, but arguably the most important one. In this step, we’re going to update your budget to understand where your money has gone these last 6 months.

If you haven’t already, download or make a copy of our Personal Budget Plan Template, adapt the categories to match your spending habits, and fill out your spending for the last 6 months.

Once you’ve done a recon of where and how you spent your money over the last 6 months, ask yourself these questions:

- How often did I overspend and go into debt? How can I avoid that in future?

- Was I realistic when I budgeted for these last few months? What needs adjusting?

- Was there anything I spent my money on that was a waste?

- Is there anything I didn’t spend my money on that I regret now?

- Where did I stick to my budget, and what helped me do that? How can I channel that elsewhere?

You’ll be using the answers to these questions in the next and final step.

Step 4: Budget for the next 6 months

Now we get to the good bit: looking forward.

You’ve refreshed your goals, have a good understanding of your spending habits and checked in on how you’re tracking towards your goals. Now you can start to plan and budget for the next 6 months.

First, map out the fixed expenses you know you’re going to have in your personal budget, from regular payments like your rent or mortgage, to once-off costs like the family holiday. Use your learnings on where you under- and over-spent in step 3 to adjust these to be more realistic.

Based on your goal priorities and how you’re tracking towards your investing or savings targets, allocate an amount you want to save or invest each month.

Do this before the final step: filling in your planned ‘nice-to-have’ expenses, like dining out, buying clothes or going on holiday. Remind yourself of your goals and why you’re prioritising saving and investing.

Tips for setting your goals up for success

Here are some tips to use the Franc app to help motivate you to reach your goals:

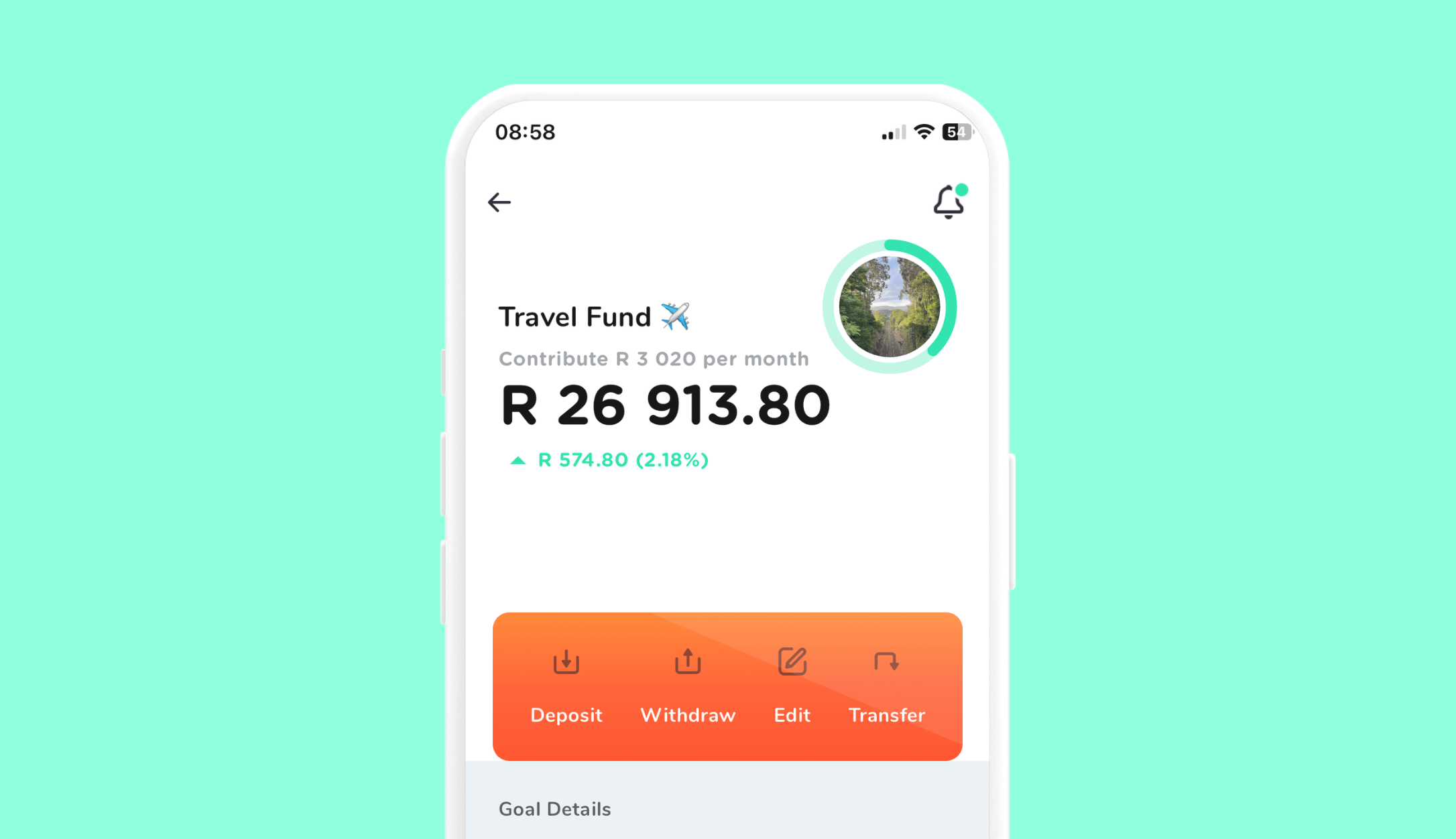

- Give your goal a personalised name, emoji and picture. It will help to really visualise what success in your goal looks like.

- Lock your goal. If you lock your goal, you have to pay a R50 fee if you want to withdraw from it before you’ve reached your target amount. It’s a small thing to stop you from dipping into your fund for unnecessary expenses!

- Take part in savings challenges. Every other month, we run a 4-week savings challenge to reignite your savings habit. Keep an eye out for our announcements, or start your own savings challenge using one of our handy downloadable savings plans.

Once you’ve done your financial reset, you should feel equipped and empowered to actively work towards your goals. My last tip: don’t feel that this is only a bi-annual event: check in on your goals, progress and budget regularly and the process will be so much simpler!

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w2000/2024/12/Setting-goals-for-the-year.png)